How Much Do Health Care Costs Increase Each Year

Seven reasons for rising healthcare costs

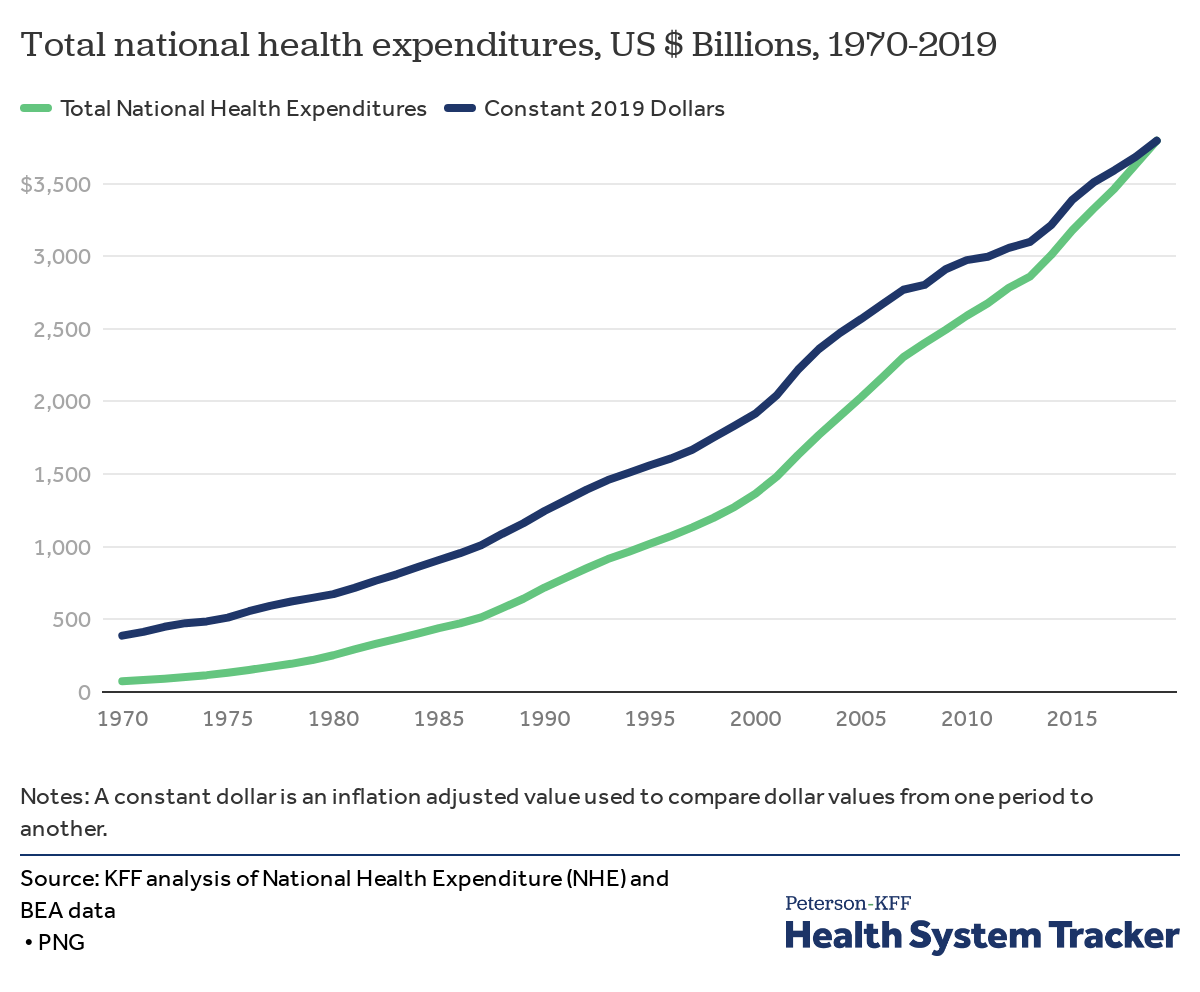

According to data released by the Centers for Medicare and Medicaid Services (CMS), total health expenditures in the U.S. have been on the rise. In 1970, health spending totaled $74.1 billion, but by 2019 that number had rocketed to $3.8 trillion. At the beginning of 2020, the outbreak of COVID-19 led health services spending to drop 8.6% in the second quarter of 2020 compared to the second quarter of 2019. This was largely due to social distancing and many Americans delaying or canceling their elective procedures. However, despite this historic drop, economists at CMS expect the pandemic's effects to be short term, with health spending projected to grow at an average annual rate of 5.4% and reach $6.2 trillion by 2028. With no end in sight to rising healthcare costs, it's important to understand what exactly causes these spikes in the first place. Let's take a look at seven reasons for rising healthcare costs in the U.S. Most insurers—including Medicare—pay doctors, hospitals, and other medical providers under a fee-for-service system that reimburses for each test, procedure, or visit. That means the more services provided, the more fees are paid. This encourages a high volume of redundant testing and overtreatment, including on patients that have questionable potential to improve their health. On top of this, our medical system is not integrated. The World Health Association defines integrated health services as "the organization and management of health services so that people get the care they need, when they need it, in ways that are user friendly, achieve the desired results and provide value for money." So what does that have to do with cost? Integrated health means providers, management, and support teams are all in communication with one another on a patient's care. On the other hand, in an unintegrated system, the lack of coordination can result in patients receiving duplicate tests and paying for more procedures than they truly need. According to the National Center for Biotechnology Information, half of the U.S. population has at least one chronic condition, such as asthma, heart disease, or diabetes, which all drive up costs. A staggering 85% of healthcare costs in the U.S. are for the care of a chronic condition. What's more, recent data from the Center for Disease Control and Prevention finds that over 40% of adults in the U.S. are either overweight or obese, which also leads to chronic illness and inflated medical spending. As the U.S. population gets sicker and more overweight, the risk involved in insuring the average American goes up. And in turn, the higher the risk, the higher the cost of insurance premiums. Data from the Kaiser Family Foundation (KFF) shows between 2015 and 2020 the average annual premiums for family coverage rose from $15,545 to $21,342—that's a whopping 37%. Medical advances can improve our health and extend our life, but they also add to the cost of healthcare and the overutilization of expensive technology. According to a study by the Journal of the American Medical Association, (JAMA) Americans tend to associate more advanced technology and newer procedures with better care, even if there's little to no evidence to prove that they're more effective. This assumption leads to both patients and doctors often demanding the newest (read: most expensive) treatments and technology available. Data from the KFF finds that roughly 49% of the U.S. population gets their insurance through their employer. That means nearly half of Americans don't actually make any true consumer decisions about the cost of their care or coverage, because it was already made for them by their employer. Organizations have an incentive to purchase more expensive healthcare plans because the amount employers pay toward coverage is tax deductible for the organization and tax exempt to the employee. In addition, low deductibles or small office co-payments can encourage overuse of care, driving both demand and cost. Despite a wealth of information at our fingertips online, there's no uniform or quick way to understand treatment options and the costs associated with them. We would never buy a car without comparing models, features, gas mileage, cost, and payment options—but yet, this is how we buy healthcare. Kaiser Health News (KHN) reports that even when evidence shows a treatment isn't effective or is potentially harmful, it takes too long for that information to become readily known, accepted, and actually change how doctors practice or what patients demand. And in too many cases, even when hospitals make their service prices available, they are difficult to navigate and understand. Many of the chargemasters that have been legally required to be made public are written using codes that only medical care professionals can understand. See our infographic to learn more about estimating your medical expenses According to the Center for Studying Health System Change, mergers and partnerships between medical providers and insurers is one of the more prominent trends in America's current healthcare system. Increased provider consolidation has decreased the market competition, which normally allows for lower prices, improved productivity, and innovation. Without this competition, these near-monopolies created in some markets have both providers and insurers in a position to drive up their prices unopposed. For example, a study done by the American Journal of Managed Care found that hospitals in concentrated markets were able to charge considerably higher prices for the same procedures offered by hospitals in competitive markets. The cost for a coronary angioplasty was found to be 25% higher, while a total knee replacement was 19% higher. Oftentimes called "defensive medicine," some doctors will prescribe unnecessary tests or treatment out of fear of facing a lawsuit. The cost for these treatments add up over time—a study done by JAMA estimates that an annual $46 billion are wasted in defensive medicine practices. This is no surprise given that our current regulatory system is structured to support the fee-for-service model of healthcare delivery and payment. The Commonwealth Fund reports that the fear that healthcare providers will withhold important services in order to stay under budget is a bigger concern to Americans than the overutilization of services. Sources: CMS, NCBI, CDC, KFF, BBC As health spending continues to climb, there's never been a better time to explore a health reimbursement arrangement (HRA)—an easy way to lower your out-of-pocket healthcare costs by getting qualified expenses reimbursed through your employer. HRAs help employers keep complete control of their health benefits budget, avoid unexpected rate increases, and save time compared to administering a group health benefit. Download our comparison chart to see which HRA is best for you and your organization While there's no one villain to blame for rising healthcare costs, understanding a few of the factors can help keep you informed and aware of your options so you can make educated choices about your care. This article was originally published on May 9, 2014. It was last updated March 15, 2021. Seven reasons for rising healthcare costs

1. Medical providers are paid for quantity, not quality

2. The U.S. population is growing more unhealthy

3. The newer the tech, the more expensive

4. Many Americans don't choose their own healthcare plan

5. There's a lack of information about medical care and its costs

6. Hospitals and providers are well-positioned to demand higher prices

7. Fear of malpractice lawsuits

A more affordable alternative

Conclusion

Topics: Health Benefits, Healthcare Costs

How Much Do Health Care Costs Increase Each Year

Source: https://www.peoplekeep.com/blog/seven-reasons-for-rising-health-care-costs

0 Response to "How Much Do Health Care Costs Increase Each Year"

Post a Comment